Managing insurance claims in-house presents several significant challenges that can impact efficiency, cost, and customer satisfaction. Here are some of the key issues insurers face:

- High operational costs: Maintaining an in-house claims team and investing in claims management infrastructure can be expensive, leading to higher overall operational costs.

- Scalability challenges during high claim volumes: Fluctuating claim volumes, particularly during peak seasons or after major events, make it difficult for insurers to scale resources up or down without incurring high costs.

- Inefficient processing: High volume low severity claims management requires significant time and resources, which can take focus away from more complex areas.

- Risk of compliance and fraud issues: When In-house teams are stretched or you don’t have the expertise, you run the risk of failing to detect fraud or complying with regulatory standards.

- Slower settlement: When you can’t manage the full claim’s lifecycle in-house including technical processing it can slow you down leading to customer dissatisfaction.

- Talent retention: Attracting and retaining specialist talent across multiple lines of business is not easy in the London Market.

We provide end-to-end claims service

To address these challenges, we offer comprehensive claims management services designed to optimise efficiency, reduce costs, and enhance customer satisfaction. Here’s how our solutions can benefit your business:

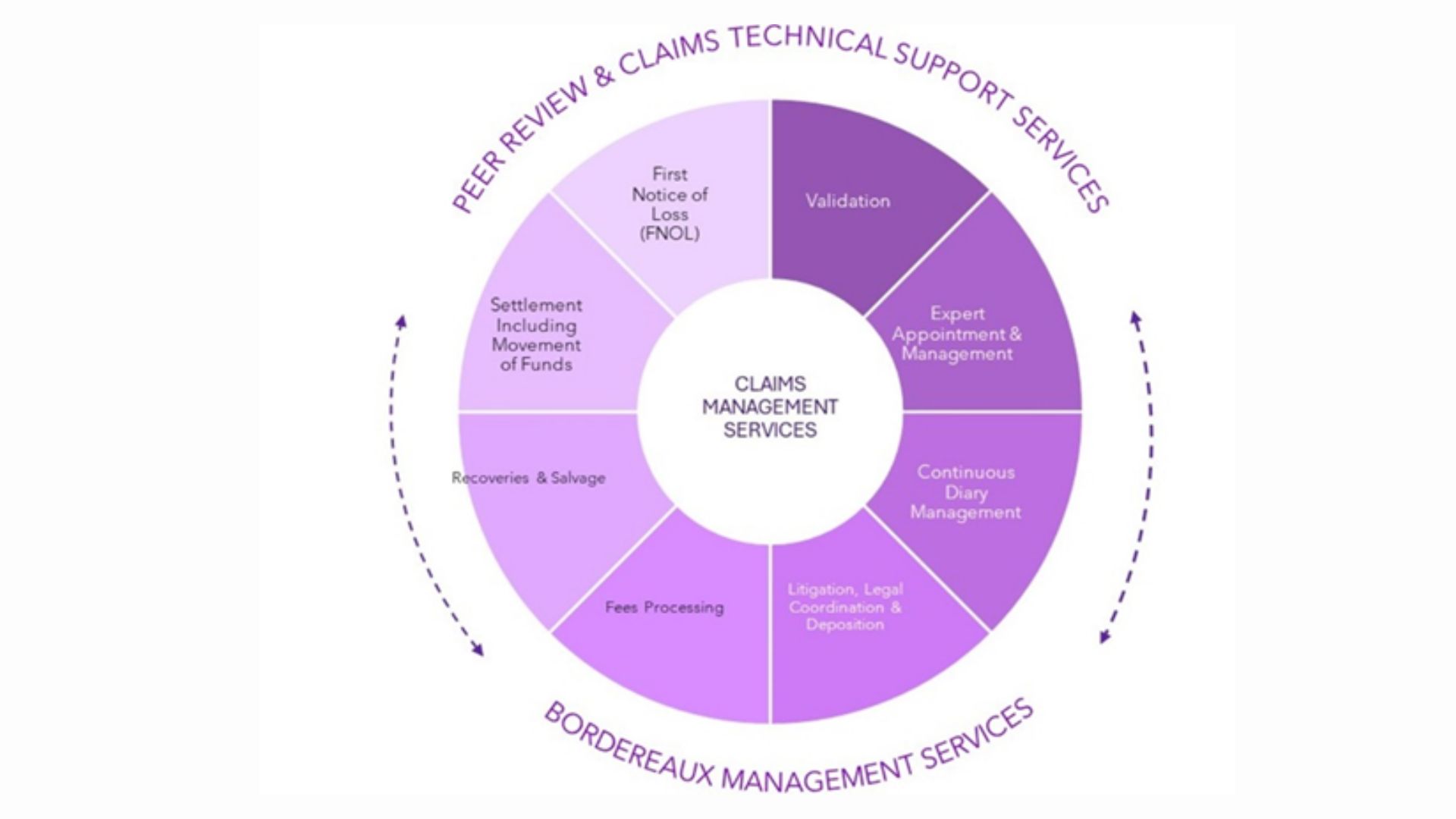

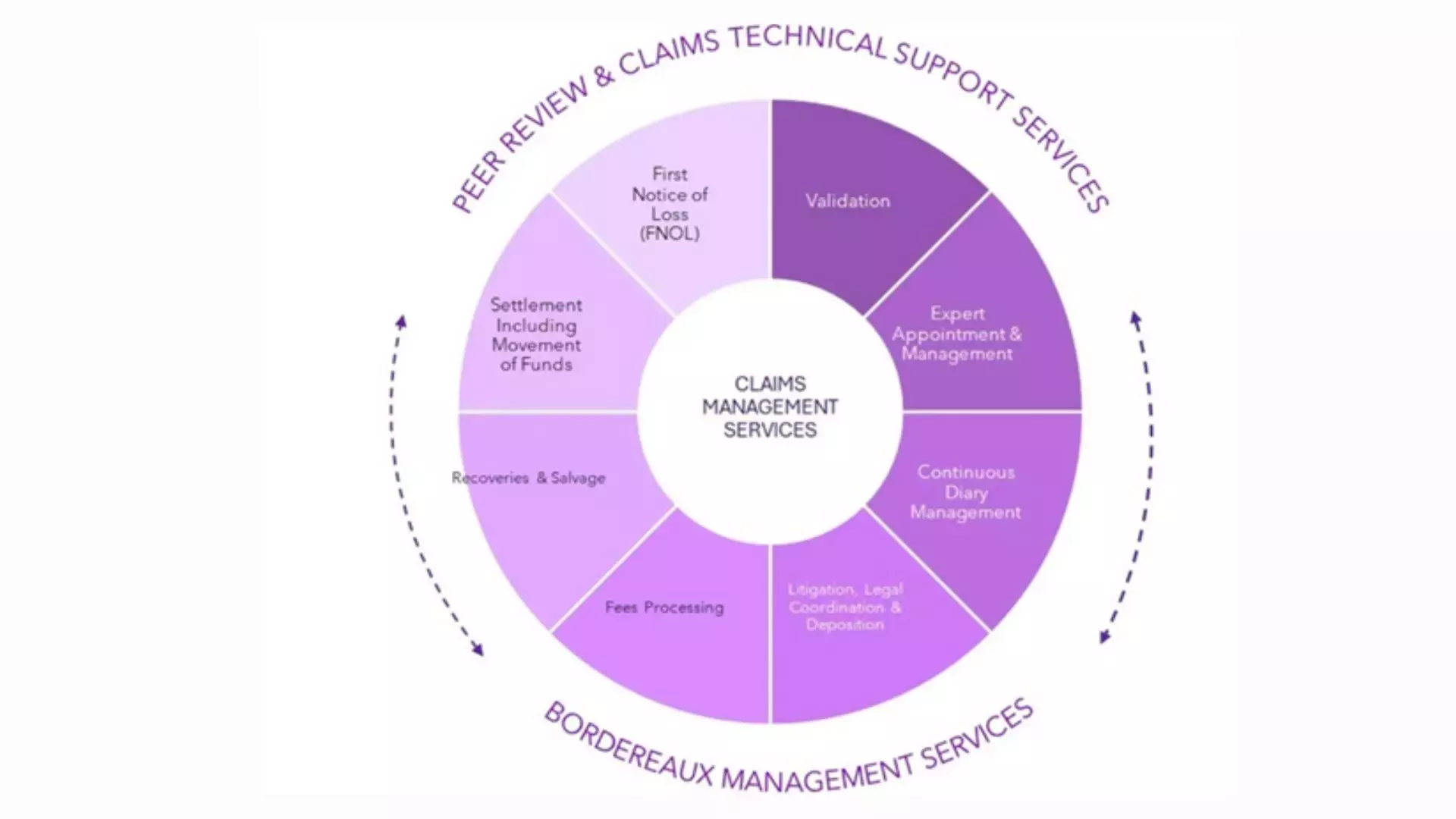

Holistic insurance claims management lifecycle

Our Claims services proactively manage claims throughout the claim lifecycle, including Triage, FNOL, Validation, Investigation, Expert Appointment and Management, Continuous Diary Management, Litigation, Fee processing, Salvage and Recovery, and Settlement.

Multi-line expertise

We have specialist experts across all lines of business.

Flexible resources

Our resources can flex according to seasonal demand or as your business grows.

Seamless integration

We act as an extension of your claims team, which means you experience a seamless and transparent service that integrates directly with your platforms and processes.

Philosophy adherence

We adhere to our customer’s claims philosophy and reserving polices, which means we can ensure consistency.

Tailored solutions

We know you have unique business needs, so we would work with you to optimise your operating model, resources, and skill sets.

Our competitive edge

Choosing our services means partnering with a team that offers unparalleled expertise, extensive market contacts, and comprehensive support throughout the entire claim’s lifecycle. Here’s why we stand out:

Largest adjusting team

We have one of the largest claims adjusting teams in the London insurance market.

1,000+ years expertise

With over 1,000 years of combined experience, our London Market expertise ensures tailored solutions and efficient placement.

Market contracts

Because we have extensive market contacts, we are uniquely positioned to serve our customers whether they are insurers, brokers and third-party organisations we are uniquely positioned.

Faster settlement

It also means we can provide faster claims settlement.

Technical Board

Our Technical Board has a combined 150 years of experience, which means we can help you develop opportunities, oversees technical referrals, and ensures compliance.