In today’s fast-paced insurance environment, not having access to meaningful data can lead to:

-

Poor decision-making impacting profitability.

-

Inefficient risk selection.

-

Compliance and regulatory pressures.

-

Rising operational costs and inefficiencies.

The consequences are clear: decreased profitability, SLA breaches, lost opportunities and financial penalties from regulators.

Are you ready for the challenge?

Our Data Insights Platform empowers your organisation to overcome these challenges and drive smarter decisions across all functions.

Benefits

How our Data Insights Platform can help

We provide a robust, integrated solution that helps you streamline operations, ensure compliance, and solve your most pressing data challenges.

Enhance decision-making across the insurance lifecyle:

Make Better Underwriting Decisions

Access critical insights to refine your underwriting strategies:

-

Analyse profitability over time and adjust risk appetite accordingly.

-

Identify favourable risks outside risk profiles.

-

Understand loss trends and distinguish between one-off major losses and recurring patterns.

Optimise Loss Ratio Analysis:

-

Gain in-depth visibility into your book of business

-

Pinpoint profitability trends with loss ratio analysis over specific periods.

-

Drill down into detailed claims data to investigate unprofitable years and identify root causes.

Enhance Regulatory Compliance

You face pressure from growing reporting requirements and the challenge of accurately managing large volumes of data. Let our Data Insights Platform simplify the complexities of evolving compliance demands.

Comprehensive Reporting:

Stay compliant with robust reporting features:

-

Generate accurate regulatory filings and reports for entities like Lloyd’s, including premium and claims data.

-

Assists managing agents by supplying up-to-date regulatory filings and reports on Insurance Premium Tax (IPT) and VAT spending.

The absence of meaningful premium and risk insights can lead to stalled processes, increased inefficiencies, and poor-quality premium submissions, impacting your bottom line.

Our Data Insights Platform support your business with:

Claims workflow analysis

Stay compliant with robust reporting features:

-

Track the resolution process of claims from first notification to settlement, identifying bottlenecks and inefficiencies.

-

Insights into claim performance and helps identify where delays occur, whether with brokers or managing agents.

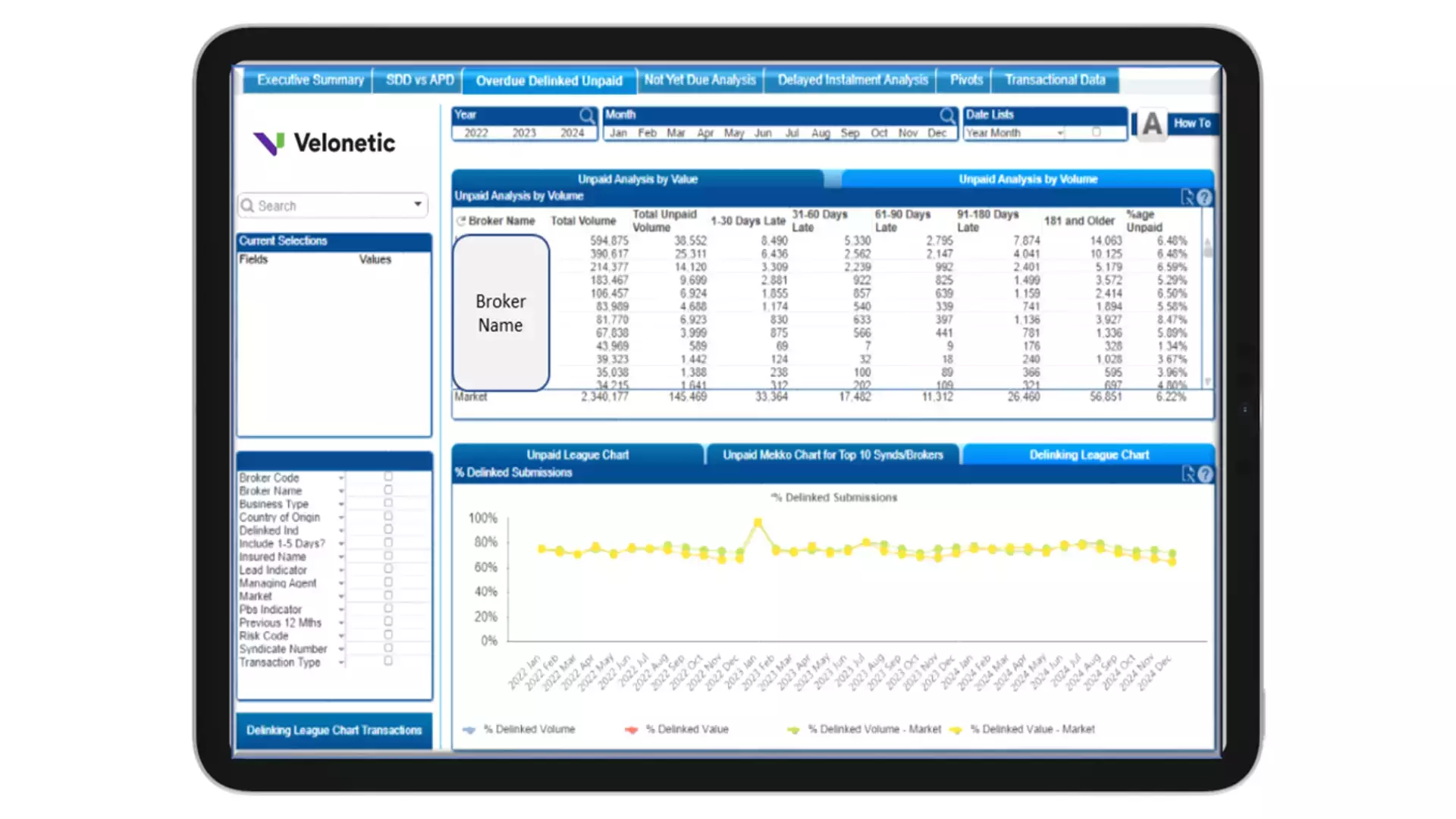

Submission Quality Tracking

-

Monitors the quality of premium submissions, helping identify and rectify issues that lead to rejections.

-

Offers data that brokers can use to improve training and submission accuracy.

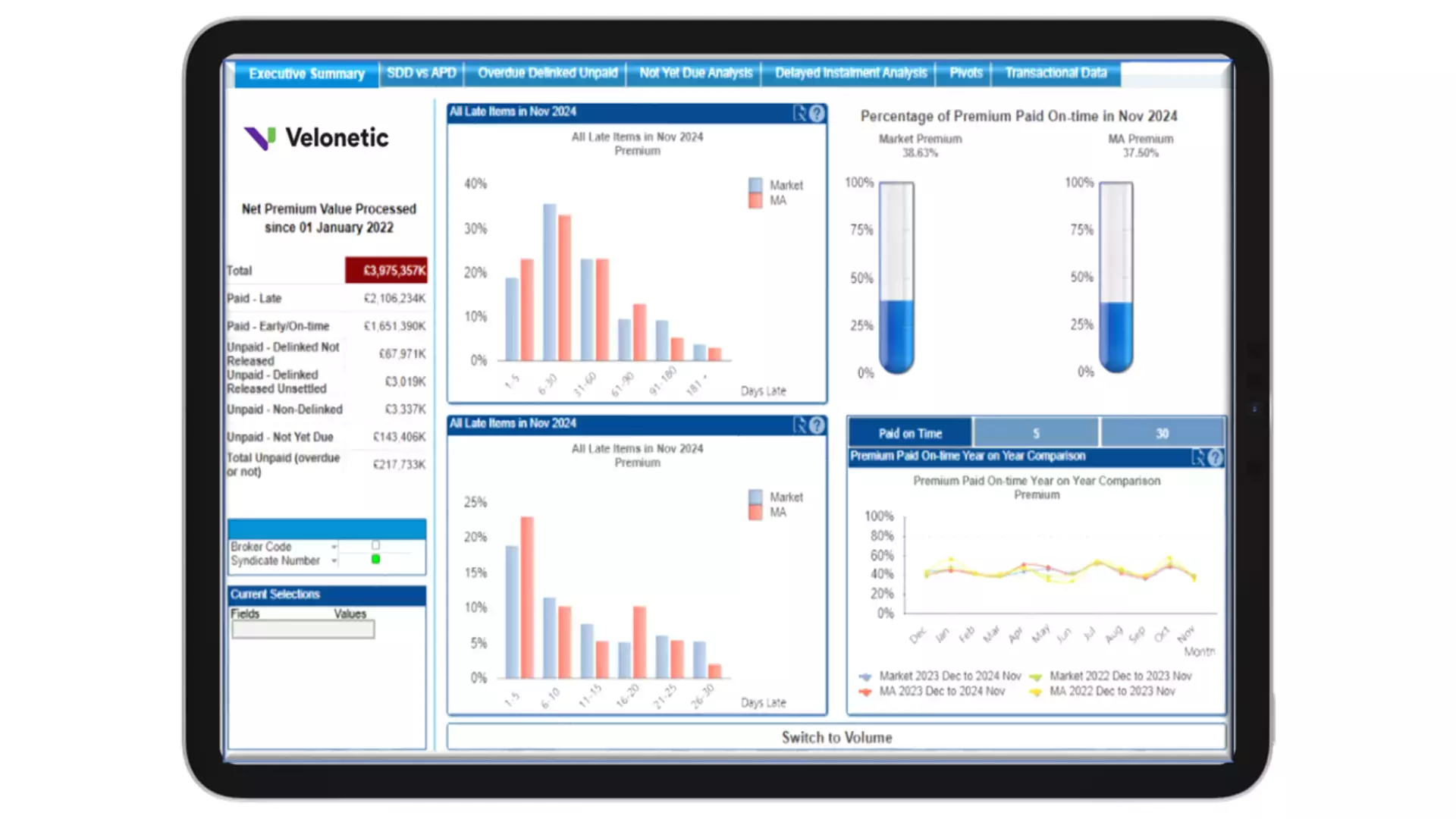

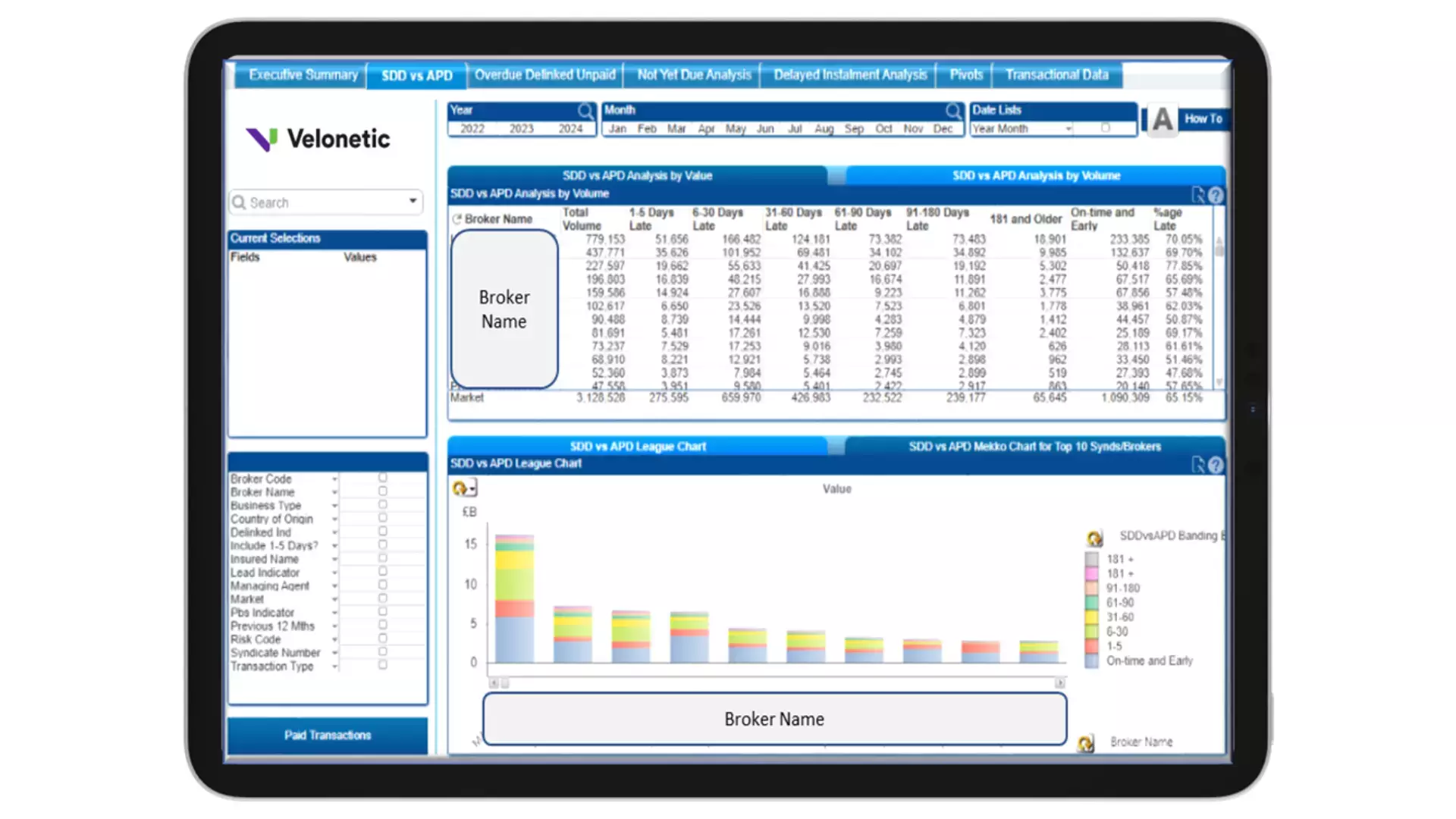

Credit Control Reporting

-

Supplies detailed reports on premium payments, tracking whether they are made on time and highlighting outstanding amounts.

-

Supports proactive management of receivables and cash flow optimisation.

A lack of meaningful insights and reports can result in poor decision making over profitability, over or under reserving and taking on unnecessary risks. Let our Data Insights Platform help protect your bottom line with:

Financial Reporting and Analysis

-

Detailed premium income reports split by risk code, market broker, and claims data.

-

Evaluate reserve positions, incurred claims, and expenditure on experts like loss adjusters and lawyers.

Profitability and Risk Assessment

-

Insights into the profitability of business lines and broker performance, enabling strategic decision-making.

-

Identification of high-risk brokers or business areas through loss ratio analysis.

Business Development Insights

-

Identification of brokers contributing to high claim volumes, informing business development strategies and risk assessments.

Operating without meaningful insights and reports can lead to:

-

Under or over reserving.

-

Risk of outsourced expert costs escalating.

-

Breaching SLAs.

Our Data Insights Platform can enhance your claims management and operations with:

Comprehensive Claims Reporting:

-

The largest claims reporting suite in the market, offering detailed insights into claims management for Managing Agents.

-

Enables managing agents to monitor expert management spend, track static claims, and assess reserving adequacy.

Workflow and Performance Analysis

-

Analyses the entire claims process from opening to closure, allowing managers to identify trends and areas for improvement.

-

Facilitates the tracking of catastrophe claims, providing data on claim volumes and values related to specific events.

Reserve Adequacy Monitoring

-

Offers tools to match initial reserves with actual claim costs, helping identify under-reserved claims.

-

Provides insights into reserve adequacy, ensuring that claims are adequately funded.

Market-Wide Service

-

While currently available for managing agents under Lloyd’s, the claims management service demonstrates potential for broader application across different markets and brokers.

Reports

Why choose our Data Insights Platform?

in unpaid premiums

customers use the platform

individual users of the platform

reports delivered annually

standard reports available

Explore how our Data Insights Platform can help you make smarter, faster decisions